How I arrived at the Carbon IRA (individual retirement Account)

I’m thinking maybe a little more context is necessary for people to “get” the Carbon IRA (individual retirement account) concept and why my book, Carbon IRA + YouTility: How to Address Climate Change and Reduce Carbon Footprint Before Its Too Late, has such salient […]

How I arrived at the Carbon IRA (individual retirement Account)

I’m thinking maybe a little more context is necessary for people to “get” the Carbon IRA (individual retirement account) concept and why my book, Carbon IRA + YouTility: How to Address Climate Change and Reduce Carbon Footprint Before Its Too Late, has such salient messages.

A chemical engineering education and electricity industry career pretty much makes you a systems person. You think in terms of systems, boundaries, and surroundings. After several decades in the electricity and energy sectors, and wrestling with the macro-carbon footprint challenge, I finally realized a few things weren’t going to change anytime soon:

- Economic growth is predicated on buying and consuming stuff

- Low cost energy supports economic growth

- Carbon-laden fossil fuels are the backbone of low-cost energy, especially electricity

- Therefore, carbon is the ultimate externality – the environmental impact that isn’t properly reflected on the accounting ledger

- Thus, until carbon-free energy replaces fossil fuels, we are doomed to aggravate carbon-induced climate disruption.

These aren’t immutable “truths” like the laws of thermodynamics. But they sure have been immutable in my lifetime. At least globally. So the “problem statement” is pretty straightforward.

When my two daughters were in high school and college, we had many dinner conversations about dad’s job (electricity industry) and climate change (what my daughters were having nightmares about). I kept saying, until everyone on the planet learns to consume less and we accelerate the transition to renewable energy sources, it will get worse before it gets better. And it has.

So we came up with this slogan. Think:Less! Note the double meaning. Think less, or simplify how you think about global climate change. Think about consuming less stuff. Period. End of Story. We even made a stack of bumper stickers!

Of course, no one really knew what the hell we were talking about. But it led me to the more important challenge. Environmentalists have been preaching the three Rs – reduce, recycle, reuse – in my memory ever since the first Earth Day in 1970. By the new millennium, that still wasn’t working.

After more dinner conversations, I had an epiphany.

- You have to reverse the growth-at-any-cost economic mantra

- One approach is to reward behavior and consumer choices which result in less carbon

- If you make the behaviors permanent, you can make progress on carbon and climate

- You can’t depend on volatile energy price signals to sustain these behaviors

- Converting the avoided carbon into money is a bona-fide incentive

- Putting the money towards a retirement account encourages a lifetime of better behaviors and choices.

Hence, the carbon IRA concept was born. It turns traditional economics inside out. Since nothing else seems to be working fast enough, maybe it’s time for a radical departure?

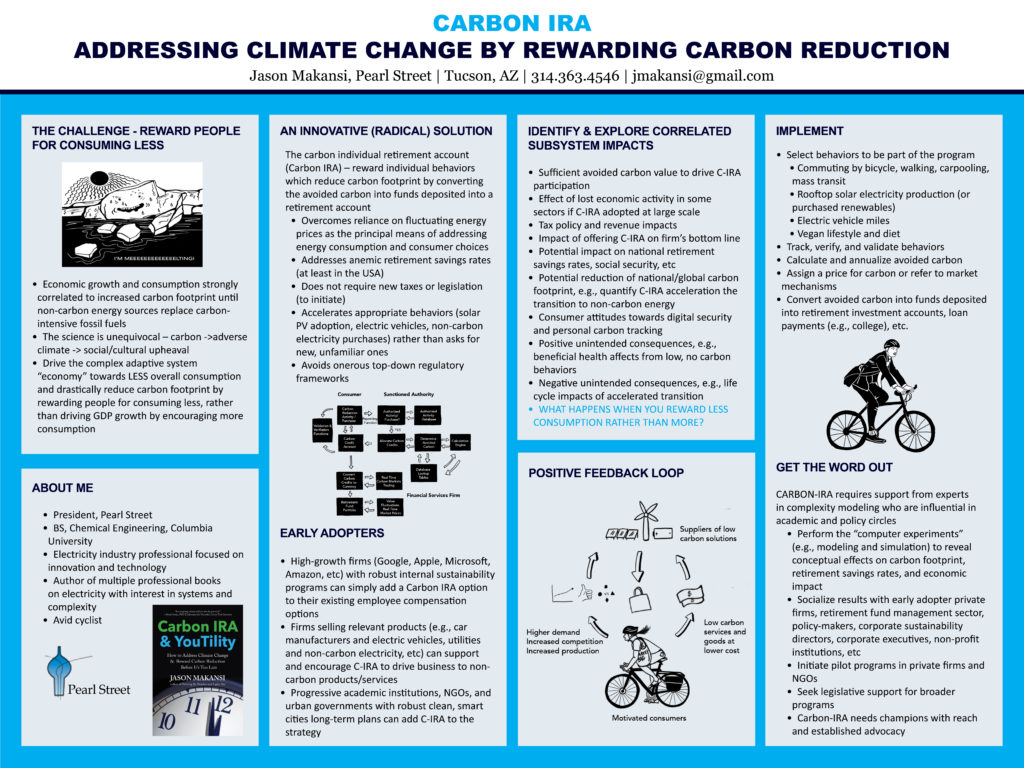

It was a honor to be selected to participate in the New England Complex Systems Institute International Conference on Complex Systems (ICCS2020) in July 2020 and present the Carbon Individual Retirement Account (Carbon IRA) concept. Here’s the poster I presented:

It was a honor to be selected to participate in the New England Complex Systems Institute International Conference on Complex Systems (ICCS2020) in July 2020 and present the Carbon Individual Retirement Account (Carbon IRA) concept. Here’s the poster I presented:

I

It’s a memory that’s fading but for the first earth day in 1970, a popular DJ in Chattanooga, TN (one of two places I grew up), Chickamauga Charlie, and his radio station sponsored a city-wide cleanup. My family lived in what were then pretty remote suburbs, but I remember that day trudging through parts […]

I

It’s a memory that’s fading but for the first earth day in 1970, a popular DJ in Chattanooga, TN (one of two places I grew up), Chickamauga Charlie, and his radio station sponsored a city-wide cleanup. My family lived in what were then pretty remote suburbs, but I remember that day trudging through parts of the city I’d never seen before with kids I’d never interacted with before. We cleaned up city streets and vacant lots with the kinds of junk I’d only seen in the huge junkyard my dad occasionally went to for car parts. Change – and teenage optimism – were in the air!

For the 20th anniversary of Earth Day, I launched a monthly newsletter called Common Sense on Energy and Our Environment. My wife and I published it for six years but it really never took off. I learned something that would presage the bitter partisan divide America faces today: People paid lip service to the value of an independent, objective publication on controversial environmental issues, but they would only support one that advocated for “their side.”

For this 50th anniversary, my uplifting message is that reducing our carbon footprint shouldn’t be as difficult as people make it out to be. We can address half the carbon footprint challenge by the 70th anniversary of Earth Day or even earlier by implementing on two ideas:

- Create long-term or lifelong permanent incentives for individuals to reduce their carbon footprint (electric vehicles, biking or walking to work, meatless diet, rooftop PV, energy conservation, etc) by converting the avoided equivalent carbon into funds deposited in retirement accounts or other long-term financial obligations. I call this the Carbon IRA

- Allow electric utilities to own non-carbon distributed and on-site energy infrastructure for homes, buildings, and large facilities (solar PV, storage devices, EV chargers, smart thermostats, state of the art HVAC, etc); apply the regulated rate of return business model; unleash a new frenzy of responsible investment; and displace fossil-based resources with non-carbon.

Most experts agree that greater electrification based on renewables and nuclear, along with electric transportation, is the ultimate path (along with minimizing resource consumption in the first place). These two policy pillars will get us there faster, better, and less expensively. Along the way, there will plenty of opportunity for natural gas fired power plants, firing US sourced natural gas, to handle the intermittency of renewable energy.

We can convert electricity from climate disruption villain to climate solution hero!

As part of a larger US infrastructure rebuild, such a strategy can satisfy many seemingly conflicting political forces – globalism (address carbon-induced climate disruption), nationalism (focus on US infrastructure needs), rural populism (jobs, jobs, jobs), liberalism (yes, an industrial policy), and conservatism (incentives to change behavior, not laws).

Why do I say it’s not that hard? We built out the largest “machine,” the post WWII US electricity grid in twenty five years using the utility regulated rate of return business model and it now drives the entire economy (sadly, without appropriate recognition). Economists prove over and over again that properly aligned incentives can quickly and substantially change consumer behaviors.

All we need is the collective will to confront multiple emergencies – the ticking clock of climate change, the anemic retirement savings of most Americans, the indebtedness of many young adults, and the consequences of rampant global, unchecked, capitalist ambition, now staring at us every time we look in the mirror with our COVID19 masks on.

And guess what? We could again lead the world to a better place.

So much “painting by numbers” is done with numerical models. And the government is probably the largest consumer of such models. All models require assumptions, and as Commandment 2 in “Painting By Numbers” counsels, you must identify these assumptions to understand the results.

The need for assumptions gives policy-makers wide latitude to drive towards answers which […]

So much “painting by numbers” is done with numerical models. And the government is probably the largest consumer of such models. All models require assumptions, and as Commandment 2 in “Painting By Numbers” counsels, you must identify these assumptions to understand the results.

The need for assumptions gives policy-makers wide latitude to drive towards answers which support their policies. For example, the EPA under the Obama administration calculated the “social cost of carbon” as a value around $50/ton of carbon emitted. The EPA under the Trump administration managed to tweak the model so that the social cost of carbon (SCC) was more like $7/ton.

I wrote about this a while back in this space. Apparently, one thing you can do is select a different value for the internal rate of return (a financial parameter) in the model, according to a few references I read at the time.

Now here’s some fun: A paper I found surfing the web entitled “The Social Cost of Carbon Made Simple” shows one methodology for calculating it. By the way, this has got to be the most wrongly titled paper of 2010, the year it was published. There is nothing simple about it! Go on – click on it and read the first few pages. I dare you.

But the paper does acknowledge that a “…meta-analysis…found that the distribution of published SCC estimates spans several orders of magnitude and is heavily right-skewed: for the full sample, the median was $12, the mean was $43, and the 95th percentile was $150…” Moreover, the spread was as low as $1/ton.

See what I mean? If you want to de-emphasize carbon in your economic policies, you pick a methodology that minimizes SCC. If you want to build your policies around climate change, you pick a method that maximizes it. To the credit of the Obama administration, they settled on something close to the mean.

The paper is provisional work and nine years old, so don’t take it for any kind of gospel. I use it simply to illustrate points that require of the paper neither absolute accuracy or timeliness.

In an article (New York Times, March 27, 2020) titled “Trump’s Environmental Rollbacks Find Opposition From Within: Staff Scientists,” I read this: “In 2018, when the Environmental Protection Agency proposed reversing an Obama-era rule to limit climate-warming coal pollution, civil servants included analysis showing that by allowing more emissions, the new version of the rule would contribute to 1,400 premature deaths a year.”

I’m not going to dig deep and determine how they arrived at the number 1400, and anyway, the key to the sentence isn’t the number, it’s the word “contribute.” How many other factors “contribute to those premature deaths?

The article argues that Trump administration officials are not even trying to “tweak” the models, but instead have come in with a “repeal and replace” attitude “without relying on data, and science and facts.” It was reported that Obama’s head of the EPA, before she departed, had encouraged staffers to remain and make sure that EPA’s analyses have the “truth” put in there.

Unfortunately, numerical models don’t cough up the truth, just someone’s version of it. Those who don’t take the time understand all of this become victims reduced to parroting others’ versions of the truth. On the other hand, not even being willing to consider data and science and facts is completely wrong-headed. That is ignorance, as any model of human behavior will tell you.

Policy-makers are probably the worst offenders when it comes to using and abusing mathematical modeling and numerical analysis, the subject of my latest book, Painting By Numbers: How to Sharpen Your BS Detector and Smoke Out the Experts. When it comes to the administration’s rollback of the global climate change regulations and specifically the […]

Policy-makers are probably the worst offenders when it comes to using and abusing mathematical modeling and numerical analysis, the subject of my latest book, Painting By Numbers: How to Sharpen Your BS Detector and Smoke Out the Experts. When it comes to the administration’s rollback of the global climate change regulations and specifically the Clean Power Plan, however, one number which really matters is 3. That’s the number of times the Supreme Court has ruled in favor of the Environmental Protection Agency’s authority to regulate carbon dioxide under the Clean Air Act Amendments.

This means that the Administration cannot just end the Clean Power Plan, central to the EPA’s carbon regulation strategy, but must come up with an alternative regulatory framework. The EPA concluded, and the Supreme Court upheld, an endangerment finding for carbon pollutants, and therefore the agency is legally required to regulate carbon emissions.

Ironically, this is similar to the repeal, replace, repair problem with the Affordable Care Act. You can’t just “repeal” EPA’s carbon regulations, and it will be difficult to replace them. So, repair is probably going to be the sensible option.

Nothing is easy when it comes to federal regulations and that’s the way the framers of our Constitution intended.

People need to save more for retirement. The planet could do with much less carbon in the atmosphere. Combine the two. Climate change problem solved.

If you want to debate whether global climate change is “real,” argue about how severe the impacts are and will be, or whether humans should even be contemplating behavioral and […]

People need to save more for retirement. The planet could do with much less carbon in the atmosphere. Combine the two. Climate change problem solved.

If you want to debate whether global climate change is “real,” argue about how severe the impacts are and will be, or whether humans should even be contemplating behavioral and economic changes to manage global climate change, kindly check out of this post now.

Rather, this post explains a conceptual and, if I do say so myself, elegant (on paper) means of reducing carbon discharged into the atmosphere as individuals participating in our economy.

First, recognize that when we talk seriously about reducing carbon, by default we are talking about massive social and behavioral change. Don’t let anyone convince you otherwise. Individually, and as a society, we emit carbon everywhere, our mouths, our automobile tailpipes, our furnaces, our sources of electricity (unless nuclear, hydro, wind, solar, or other non-carbon source), our offices, our schools. Everywhere!

I have been an electricity/energy industry professional for 35 years, and have been in the middle of environmental management and global warming debates for all of that time. There have long been two gaping holes in climate change “solutions.” They fail to appropriately account for individual responsibility and change and they fail to offer long-term incentives for changing behavior. Most of the time, I throw up my hands at the complexity of the problem and the solutions (at least from a systems, multi-dimensional perspective), and conclude, that there is only one way to articulate the solution: Use less! Consume less. Have less stuff. Reduce your life’s footprint, whether you measure it in carbon, dollars, community, locavores, etc.

Yes, there are periods when people collectively are not only acutely aware of environmental issues but engaged with them. Usually, they are short-lived episodes, always coinciding with periods of escalating energy prices. When prices return to “normal,” people go back to complaining but not doing.

Why do we go to work, earn money? Because the economy revolves around money. If we don’t have money, we starve. If we make more than we need for survival, we thrive. We can even have fun, have more leisure, etc. One of the basic tenets of a modern economy is that we save for when we are older and can’t work, or don’t want to. We contribute to government programs (through payroll contributions) that help us in retirement. All modern economies do this. We save on top of that if we don’t want to just “subsist” when we quit earning money.

This is the key to my elegant solution.

My solution has two parts: First, develop standards for monitoring carbon reduction, whether it is how you heat your home, commute to work, buy your groceries, grow you food, or school your children. You can’t manage what you can’t measure. If you take mass transit rather than drive alone to work, you reduce your carbon footprint. If you ride a bike, you reduce it even further. If you use less heat for your home than, say, the average American household (commensurate with your household size and square footage of your home) or the average home in your state or your area, you reduce the carbon footprint. If you are vegetarian, you have a smaller carbon footprint than if you are a hearty meat eater. If you home-school your children (maximize use of your home as a resource, for example) and use resources from the web, rather than travel a long way to a private school, you positively impact the carbon footprint.

You see where this is going. You need yardsticks. You need to authenticate the behavioral change with a number determined from an agreed-upon methodology. This won’t be easy. But it can be done.

Then, you can tally an individual’s carbon reduction regularly. You can tally a business, a school, a house of worship.

Now, imagine you make behavioral changes with carbon reductions for your entire working career. In a bank somewhere, quietly summing over the course of that career or life, are your “carbon reduction credits.” What if the government treated this just like an IRA or a 401K? Over the course of your retirement, the government rewarded you. The more carbon emissions you avoided, the larger your carbon IRA/401K-like savings account is. The means of reward could be discussed. It could be lower taxes (this is how IRA and 401K programs work today and the tax advantages are compelling). It could be social security like payments. For young people, it could be student debt forgiveness. It could be a choice that changes over the course of your life. But it has to be something substantial. something that makes you want to sacrifice for the long term in the same way you sacrifice the now for retirement, spending today for the kids’ college tomorrow, and so on.

Ever seen the national debt clock? How fast it spins? Think if a plurality of Americans contributed to their personal carbon avoidance or carbon credit clocks and thereby a national carbon clock.

Now, I have not figured out how the government will back these payments with real money. Then again, the federal government has unfunded liabilities coming out the wazoo, war expenditures which are off the “balance sheet,” oodles of treasury bills held by China and Japan (and god knows who else), and the dollar is strengthening! Which goes to show you, the amount of debt is immaterial, if your country is still, in a relative way, considered the safest bet out there. Controlling the high seas, the skies, the digital air waves, and the global monetary network probably doesn’t hurt either. But I digress.

I hesitate to suggest that at the end of each year, along with our tax returns, and other end-of-year financial record-keeping, we could also have carbon credit filing? God, I more than hesitate. To think of one more government form on the order of the tax code? Ugh! BUT, you know, if you want to solve a long-term, global problem, then everyone has to be in it to win it. It doesn’t have to be complicated (although I recognize the vagaries of bureaucracy mitigate against simplicity over time), and maybe on-line record-keeping or even automation through our personal digital devices could help.

Only carrots or sticks permanently alter behavior. You can force automobile manufacturers to make more efficient cars. You can force electric utilities to use less fossil fuel. You can spend a great deal of money to put in light rail and bus lines. You can hector people about living more simply. But the best way to achieve long-term behavioral changes is to incentivize individuals to change the way they consume stuff. Energy is consumed in and of itself and as part of every bit of “stuff” that’s made, acquired, and disposed of. That’s why carbon reduction is an exceedingly difficult problem. And that’s why you have to solve the problem at its source, rather than shifting the problem from one part of the economic system to another like the bathtub ring in The Cat in the Hat. In a consumer-based economy, consumers are the source.

Develop standards for monitoring and aggregating individual carbon reductions and reward that behavior with the equivalent of a retirement account. Instead of talking about carbon cap and trading schemes, which will only create more financial engineering shenanigans from the wizards of Wall Street, push it down to the consumers. Reward us for doing the right thing, not the bankers for manipulating trading markets. Make the incentive something besides an Energy Star designation from the EPA, or a LEEDS platinum for an energy-efficient commercial building, or a subsidy to a energy company for some people paid for by other people (like most rooftop solar incentive schemes).

People need more for retirement. The planet needs less carbon in the atmosphere. Combined the two. Problem solved. I am of course being tongue in cheek. It would be a massive undertaking to implement the solution I describe here. But similar things have been done on a grand scale before. Income tax has only been a permanent fixture in this country for 101 years. On climactic scales, that’s not that long. IRAs were established forty years ago.

This is FREE WARE, OPEN SOURCE. Take the idea, the money, the whatever, and run!

Recent Posts

- What Debussy, data mining and modeling have in common…

- Turning Traditional Economics Inside Out

- C-IRA Poster for the International Conference on Complex Systems

- The lack of error and uncertainty analysis in our science and technical communications is as pernicious as the ‘partisan divide’

- It’s just not that hard: Earth Day at 50

Recent Comments

- jmakansi on When a Favorite Short Story Expands to a Novel…

- Ronald Gombach on When a Favorite Short Story Expands to a Novel…

- Kathy Schwadel on When a Favorite Short Story Expands to a Novel…

- jmakansi on So Vast the Prison: Takes No Prisoners Regarding the Universal Plight of Women

- Elena on So Vast the Prison: Takes No Prisoners Regarding the Universal Plight of Women

Archives

- September 2020

- August 2020

- July 2020

- April 2020

- March 2020

- July 2017

- June 2017

- April 2017

- March 2017

- January 2017

- July 2016

- May 2016

- November 2015

- October 2015

- August 2015

- May 2015

- March 2015

- January 2015

- November 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- August 2013

- July 2013

- June 2013

- April 2013

- February 2013

- January 2013

- November 2012

- October 2012

- September 2012

- August 2012

- March 2012

- November 2011

- October 2011

- July 2011

- June 2011

- December 2010

- November 2010

- March 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- Error gathering analytics data from Google: Error 404 (Not Found)!!1 *{margin:0;padding:0}html,code{font:15px/22px arial,sans-serif}html{background:#fff;color:#222;padding:15px}body{margin:7% auto 0;max-width:390px;min-height:180px;padding:30px 0 15px}* > body{background:url(//www.google.com/images/errors/robot.png) 100% 5px no-repeat;padding-right:205px}p{margin:11px 0 22px;overflow:hidden}ins{color:#777;text-decoration:none}a img{border:0}@media screen and (max-width:772px){body{background:none;margin-top:0;max-width:none;padding-right:0}}#logo{background:url(//www.google.com/images/branding/googlelogo/1x/googlelogo_color_150x54dp.png) no-repeat;margin-left:-5px}@media only screen and (min-resolution:192dpi){#logo{background:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) no-repeat 0% 0%/100% 100%;-moz-border-image:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) 0}}@media only screen and (-webkit-min-device-pixel-ratio:2){#logo{background:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) no-repeat;-webkit-background-size:100% 100%}}#logo{display:inline-block;height:54px;width:150px} 404. That’s an error. The requested URL /analytics/v2.4/data?ids=ga:66373148&metrics=ga:pageviews&filters=ga%3ApagePath%3D%7Eobal-climate-change%2F.%2A&start-date=2024-03-24&end-date=2024-04-23 was not found on this server. That’s all we know.

- Error gathering analytics data from Google: Error 404 (Not Found)!!1 *{margin:0;padding:0}html,code{font:15px/22px arial,sans-serif}html{background:#fff;color:#222;padding:15px}body{margin:7% auto 0;max-width:390px;min-height:180px;padding:30px 0 15px}* > body{background:url(//www.google.com/images/errors/robot.png) 100% 5px no-repeat;padding-right:205px}p{margin:11px 0 22px;overflow:hidden}ins{color:#777;text-decoration:none}a img{border:0}@media screen and (max-width:772px){body{background:none;margin-top:0;max-width:none;padding-right:0}}#logo{background:url(//www.google.com/images/branding/googlelogo/1x/googlelogo_color_150x54dp.png) no-repeat;margin-left:-5px}@media only screen and (min-resolution:192dpi){#logo{background:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) no-repeat 0% 0%/100% 100%;-moz-border-image:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) 0}}@media only screen and (-webkit-min-device-pixel-ratio:2){#logo{background:url(//www.google.com/images/branding/googlelogo/2x/googlelogo_color_150x54dp.png) no-repeat;-webkit-background-size:100% 100%}}#logo{display:inline-block;height:54px;width:150px} 404. That’s an error. The requested URL /analytics/v2.4/data?ids=ga:66373148&dimensions=ga:date&metrics=ga:pageviews&filters=ga%3ApagePath%3D%7Eobal-climate-change%2F.%2A&start-date=2024-03-24&end-date=2024-04-23 was not found on this server. That’s all we know.